Three Myths About the Economy (That Are Destabilizing Politics and Society)

I’m Umair Haque, and this is The Issue: an independent, nonpartisan, subscriber-supported publication. Our job is to give you the freshest, deepest, no-holds-barred insight about the issues that matter most.

New here? Get the Issue in your inbox daily.

Today I want to debunk a few myths.

About the economy, and what it all means, why the election hinges on it, why pundits keep on foolishly regurgitating the same BS about it being wonderful, and how doing that at points in history like this is very bad for all of us.

I keep hearing that the economy’s on a spectrum from decent to pretty good to fantastic.

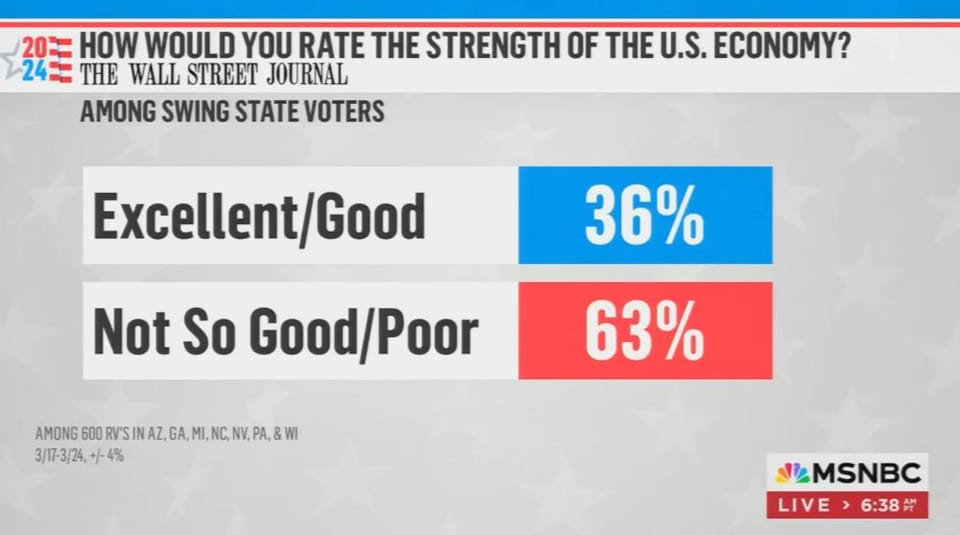

But nobody believes it. Ask people, and vast majorities will tell you things eminently aren’t wonderful. Yesterday, we discussed how that affects politics.

So. Who’s right here?

Myth One: “We Beat Inflation”

If the idea is that we conquered inflation, that’s true, but only in the weakest sense imaginable.

This current round of inflation has slowed, true. Prices, though, are still ruinously high. So much so that people are falling behind on bills, scraping to make ends meet, and delinquencies are rising. It’s rough out there.

What good does it do to say that “we beat inflation!” when prices are still astronomical? Does that help people trust institutions and leaders, or does it just make them look out of touch? What did we beat, exactly, food costing more than a Rolex?

But there’s much more to this story.

Here’s a startling finding that most people don’t know.

The average markup by publicly traded US companies surged from about 20 percent in 1980 to 60 percent today. Large incumbent businesses thus seem to be shielded more and more from competition, allowing them to jack up prices and widen profit margins.

Did you get that? The average markup’s tripled since 1980. That comes to us from the IMF—not pundit types, and it’s very, very real.

Of course, wages and incomes haven’t kept pace, and I’m going to come to that next.

First, though, think about all that this implies.

To have markups that large, industries must be concentrated, aka “shielded from competition.”

That’s what corporate strategy’s become about. Not more innovative products and services, not stuff that lifts people’s standards of living, not competing healthily to offer the best stuff on the market so much anymore as…just building gigantic monopolies. We see them now in nearly every industry, from tech to media to healthcare and beyond.

So no, we didn’t “beat inflation.” Unless we’re thinking of it in the narrowest terms imaginable—the “consumer price index,” which doesn’t include many of life’s basics, by the way. But we shouldn’t think of it that way. We should think of it in more expansive terms, more meaningful ones.

Like: how much have prices risen over time? And how much of those rising prices are markups, not just passing costs on to consumers?

When we think about the economy that way, we can immediately see: something’s going very wrong. We should never, ever see markups tripling, at least in a healthy economy, especially a capitalist one, predicated on competition. It tells us that, as many of you say, the system’s become predatory.

Myth Two: Incomes Have Risen

And people feel that way.

I read an establishment figure claim recently that incomes have risen.

They have, but again, only the narrowest sense, this time, one so blinkered it’s almost comical.

They’re back to where they were in…2019.

So that means we’ve just had a lost half decade for the vast, vast majority of people. Their lives have stagnated, or declined, because of course, as we just discussed, prices have exploded.

Incomes haven’t risen. To say that is like saying, to use a kind of tortured metaphor, that if I chopped off your arm, and it grew back, you grew a new arm. You did, but you still only have two. See what I mean? This is a kind of linguistic sleight of hand, and we shouldn’t let establishment types get away with it, because it just clouds our thinking.

When politicians like Kamala repeat this line—and I hope they don’t—their credibility declines, because, again, nobody believes it. They don’t because their lived experience doesn’t match it, and it doesn’t match because here we have a statistical illusion.

But again, the story goes much deeper.

What was the median real weekly wage? In 1979, it was just over $408. And today? It’s $401.

In other words, incomes have fallen. Over a longer timespan. If we don’t torture statistics.

That time series is for men, and I’ve chosen it because of course women’s wages were starting from zero in most cases. On the whole, for all social groups, wages have barely budged, and definitely haven’t remotely kept pace with prices.

So let’s do that trick again, but this time, for everyone. What was the median weekly wage in in 1979? $335. What is it today? $365.

Not much of a jump, is it?

If you think it is, you’re badly wrong. We just discussed how markups have tripled. Wages rising a few percentage points doesn’t remotely make up for that longer-term explosion.

So. Wages have barely budged, or fallen. Meanwhile, markups have tripled.

What does that tell us? What does it suggest?

That brings us to the next myth.

Myth Three: Everything’s Fine, and the Economy’s Booming

Let’s put together the implications of incomes barely budging or falling, while prices have gone through the roof, over longer time horizons.

Does that suggest in any remote way a “great” or “wonderful” economy? You’d have to be smoking some serious drugs to think so.

But let’s put it formally. This, again, is the IMF.

“Since 1980, labor’s share of the US economy has fallen by about 5 percentage points. The plunge was faster in industries that experienced more concentration, where large superstar firms such as Google, Apple, Amazon, and Walmart grew the most—as documented by the Massachusetts Institute of Technology’s David Autor and his research partners.”

What happens when markups explode, while incomes flatline or fall? Labor’s share of the economy gets smaller.

In other words, people enjoy a smaller share of the pie.

And what does that do?

It makes living standards decline. Or maybe even go into free fall.

Am I just making that up? Nope.

The U.S. Has Declined in Quality of Life Ranking, Dropping From 16th Place to 28th According to the Social Progress Index. The United States has experienced a troubling decline in its quality of life over the past decade, as evidenced by its plummeting ranking in the Social Progress Index.

That’s from the Social Progress Index, probably the most authoritative source there is ranking countries and standards of living globally.

Those result are exactly what we’d expect to see in a society where incomes are flatlining or falling, while markups explode. Because of course now people struggle to afford lives as good as their parents or grandparents. Downward mobility takes hold. Inequality supernovas. Life becomes a struggle. The vast majority can’t make ends meet.

And worse, in that situation, there’s less left over for the public purse, to fund what all of society needs. Critical infrastructure. Healthcare. Education. Etecetera.

So all these findings match up. They line up more or less perfectly. They all paint the same portrait for us.

That’s one of an economy that isn’t very good. One that’s struggling, a struggle for most people. One that’s gotten worse over time. One which can’t deliver like it used to. One whose standards of living are sharply declining, because its fundamentals are imbalanced and weak.

Why They Keep Telling You The Economy’s Amazing

So why do they keep on saying the economy’s great, fantastic, etcetera?

There are a number of reasons.

- A lot of them are just oafs, who don’t actually know much, and certainly not the above.

- For political purposes

- True believers never admit their paradigms failed

- For the die-hard neoliberals, none of this stuff is the economy, only profits and stock prices are

- Pundits are paid to regurgitate stuff, not think critically

In the end, there’s a gulf here. Between what people think, which is that things are in pretty bad shape, and what elites keep on saying, which is that things are fantastic.

You know who benefits from that gulf? Not democracy. Not the future. Not truth, reason, science, history. The authoritarians do, the fascists do, the crackpots do, and the lunatics do, because suddenly, they gain credibility, and maybe even win acclaim. In the absence of truth, Big Lies prevail.

That’s the big reason the election’s still so close, but we’ll talk about that another day. For now, I wanted to give you a razor sharp essay about reality. Not the BS you hear from politicians and pundits.

It’s not OK to keep on trumpeting the same old foolish myths about the economy.

After all, where have they gotten us so far?

❤️ Don't forget...

📣 Share The Issue on your Twitter, Facebook, or LinkedIn.

💵 If you like our newsletter, drop some love in our tip jar.

📫 Forward this to a friend and tell them all all about it.

👂 Anything else? Send us feedback or say hello!

Member discussion